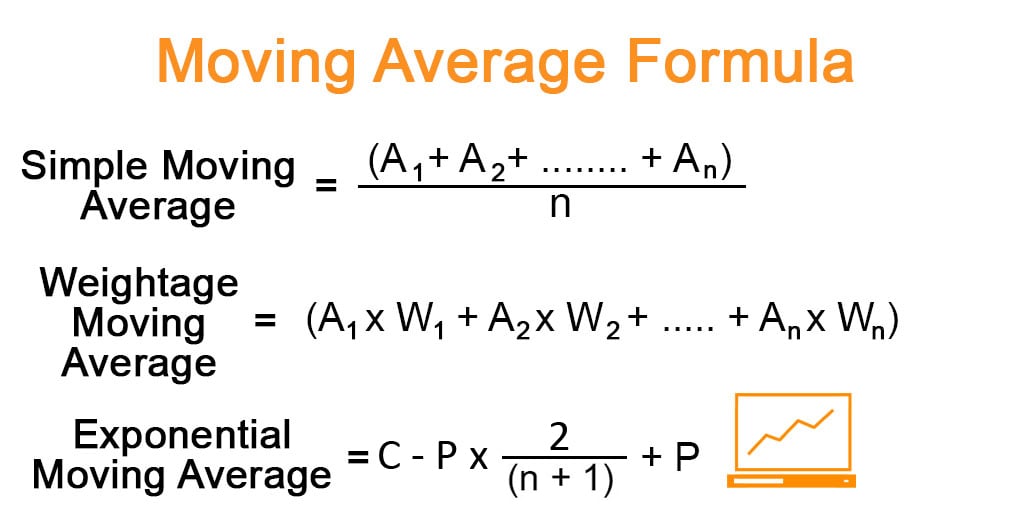

The moving averages and the colors I illustrate on Micron's chart below are the same colors that I display on every stock chart here at Trendy Stock Charts. For example, the 20 Day Moving Average is always the purple line on my stock charts.īeing consistent with chart markings makes it easier for everyone to understand, including myself, especially since I look at numerous charts for several different stocks every day. Let's review some color coordinating techniques that I use on my charts when I review moving averages. Short-term averages respond quickly to changes in the price of the underlying, while long-term averages are slow to react." The definition of a simple moving average is "A simple, or arithmetic, moving average that is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods. There are several different types of moving averages - exponential, simple, smoothing and weighted, just to name a few. I like to keep things as simple as possible, so based on the KISS theory ( Keep It Simple Stupid), I use simple moving averages on my charts. However moving averages are probably the most widely used technical indicator by investors and traders due to their ease of use. The change in the instrument’s price will lead to a change in the moving average. Moving averages look at the past opening, closing, high, and low prices of an instrument such as a currency pair and then conducts an analysis into its average price in a particular time. Read more about the Moving Average.There are hundreds of different technical indicators out there to analyze stock charts. Moving Averages (MA), some of the most common technical indicators today. Most notable are the Simple Moving Average (SMA), the Exponential Moving Average (EMA), the Weighted Moving Average (WMA) and the Hull Moving Average (HMA).

There are different types of Moving Averages which all take the same basic premise and add a variation. In fact, Moving Averages form the basis of several other well-known technical analysis tools such as the Bollinger Bands and the MACD. Because a Moving Average is a lagging indicator and reacts to events that have already happened, it is not used as a predictive indicator but as an interpretive one for confirmations and analysis. Noise is made up of fluctuations of both price and volume. Essentially, Moving Averages smooth out the “noise” when trying to interpret charts. A moving average (MA) is a technical analysis indicator that helps smooth out price action by filtering out the noise from random price fluctuations. A Moving Average is a good way to gauge momentum as well as to confirm trends, and define areas of support and resistance. World Academy of Science, Engineering and Technology Vol:6 The Use of Dynamically Optimised High Frequency Moving Average Strategies for Intraday Trading Abdalla Kablan, Joseph Falzon AbstractThis paper is motivated by the aspect of uncertainty in This is an expert system that combines fuzzy reasoning with financial decision making, and how artificial intelligence and soft the. The successful application of cycles to technical analysis is proven by mechanical trading systems which we offer for both intraday and position trading are ranked 1 in their respective categories. Better yet, our research has provided superior indicators derived directly from cycle theory. Technical analysis is a gamut of tools and techniques which are used to predict future prices of share on the basis of their past behavior. Moving Averages are price based, lagging (or reactive) indicators that display the average price of a security over a set period of time. indicators such as RSI, Stochastics, and Moving Averages. Moving Average Tool as a technique of Technical analysis for giving tentative predictions about buying and selling signals.

0 kommentar(er)

0 kommentar(er)